Featured content

EU customs and trade news: June 2025

News in week 23: US doubles tariffs on steel and aluminium imports; new import surveillance tool to help EU prevent harmful trade diversion; EU extends safeguard measures suspension on iron and … steel to support Ukraine; tariff rate quotas resume for Ukrainian products from 6 June 2025; initiation of an anti-dumping proceeding concerning imports of 1,4-Butanediol; impending expiry of anti-subsidy measures on imports of continuous filament glass fibre products; terminated investigation into imports of certain seamless iron or steel pipes and tubes; EU welcomes alignment with other countries on restrictive measures; guidance document on customs formalities in the EU for military goods; Bulgaria meets criteria to join the euro area on 1 January 2026; EU sets out its International Digital Strategy; and more updates.

EU customs and trade news: June 2025

News in week 23: US doubles tariffs on steel and aluminium imports; new import surveillance tool to help EU prevent harmful trade diversion; EU extends safeguard measures suspension on iron and steel to support Ukraine; tariff rate quotas resume for Ukrainian products from 6 June 2025; initiation of an anti-dumping proceeding concerning imports of 1,4-Butanediol; impending expiry of anti-subsidy measures on imports of continuous filament glass fibre products; terminated investigation into imports of certain seamless iron or steel pipes and tubes; EU welcomes alignment with other countries on restrictive measures; guidance document on customs formalities in the EU for military goods; Bulgaria meets criteria to join the euro area on 1 January 2026; EU sets out its International Digital Strategy; and more updates.

Articles

Tariffs – pros and cons

Discussions around US tariffs have made many people think again about the reasons and motivations behind countries imposing tariffs. Throughout history, there have been many examples of strict … protectionism and free trade between countries. Why do countries impose tariffs, who benefits from them, and who loses out? What are the consequences and risks of unjustified tariff policies? These and other questions were discussed at the 27th Authors' Meeting, which brought together customs and trade experts from Belgium, Bulgaria, Lithuania, the Netherlands, Brazil, the US and China. Read an overview of the discussion in the article below.

Tariffs – pros and cons

Discussions around US tariffs have made many people think again about the reasons and motivations behind countries imposing tariffs. Throughout history, there have been many examples of strict protectionism and free trade between countries. Why do countries impose tariffs, who benefits from them, and who loses out? What are the consequences and risks of unjustified tariff policies? These and other questions were discussed at the 27th Authors' Meeting, which brought together customs and trade experts from Belgium, Bulgaria, Lithuania, the Netherlands, Brazil, the US and China. Read an overview of the discussion in the article below.

New to defence projects? Get export control right

The article provides a practical overview of export control requirements for companies involved in the supply of military goods and technologies. It outlines the relevant regulations, explains … how military items are defined, and offers guidance on how businesses can manage compliance risks. If you are new to defence projects, this article will help you to understand your responsibilities and prepare your teams.

Sabine van Osenbrüggen

New to defence projects? Get export control right

The article provides a practical overview of export control requirements for companies involved in the supply of military goods and technologies. It outlines the relevant regulations, explains how military items are defined, and offers guidance on how businesses can manage compliance risks. If you are new to defence projects, this article will help you to understand your responsibilities and prepare your teams.

Sabine van Osenbrüggen

EU customs and trade news: June 2025

News in week 23: US doubles tariffs on steel and aluminium imports; new import surveillance tool to help EU prevent harmful trade diversion; EU extends safeguard measures suspension on iron and … steel to support Ukraine; tariff rate quotas resume for Ukrainian products from 6 June 2025; initiation of an anti-dumping proceeding concerning imports of 1,4-Butanediol; impending expiry of anti-subsidy measures on imports of continuous filament glass fibre products; terminated investigation into imports of certain seamless iron or steel pipes and tubes; EU welcomes alignment with other countries on restrictive measures; guidance document on customs formalities in the EU for military goods; Bulgaria meets criteria to join the euro area on 1 January 2026; EU sets out its International Digital Strategy; and more updates.

EU customs and trade news: June 2025

News in week 23: US doubles tariffs on steel and aluminium imports; new import surveillance tool to help EU prevent harmful trade diversion; EU extends safeguard measures suspension on iron and steel to support Ukraine; tariff rate quotas resume for Ukrainian products from 6 June 2025; initiation of an anti-dumping proceeding concerning imports of 1,4-Butanediol; impending expiry of anti-subsidy measures on imports of continuous filament glass fibre products; terminated investigation into imports of certain seamless iron or steel pipes and tubes; EU welcomes alignment with other countries on restrictive measures; guidance document on customs formalities in the EU for military goods; Bulgaria meets criteria to join the euro area on 1 January 2026; EU sets out its International Digital Strategy; and more updates.

Ukraine customs and trade news: April/May 2025

News in brief: the revised Customs Code of Ukraine come into force; the system for granting customs authorisations updated; modernised Ukraine-EFTA FTA signed; the transition period for the updated … rules of origin within the PEM Convention framework started; anti-dumping duties extended and new investigations launched; Ukraine AEO authorisation progress.

Ukraine customs and trade news: April/May 2025

News in brief: the revised Customs Code of Ukraine come into force; the system for granting customs authorisations updated; modernised Ukraine-EFTA FTA signed; the transition period for the updated rules of origin within the PEM Convention framework started; anti-dumping duties extended and new investigations launched; Ukraine AEO authorisation progress.

Videos

Courses

Glossary

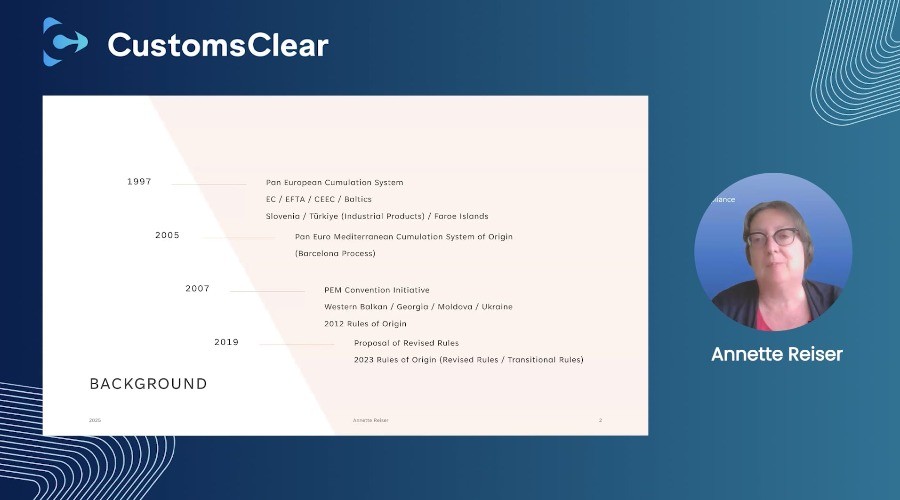

Pan-European-Mediterranean (PEM) Zone

The Pan-European-Mediterranean Zone was implemented in 2005. The idea was to create a cumulation zone between Europe and its neighbours and to encourage intra-regional integration by promoting … trade and cooperation. The PEM Convention allows for the cumulation of origin between different countries within the zone. Cumulation of origin is one of the ways to allow for greater flexibility when it comes to using raw and semi-manufactured materials in the production process. It allows a member of a trade agreement to use originating products from other members.

Pan-European-Mediterranean (PEM) Zone

The Pan-European-Mediterranean Zone was implemented in 2005. The idea was to create a cumulation zone between Europe and its neighbours and to encourage intra-regional integration by promoting trade and cooperation. The PEM Convention allows for the cumulation of origin between different countries within the zone. Cumulation of origin is one of the ways to allow for greater flexibility when it comes to using raw and semi-manufactured materials in the production process. It allows a member of a trade agreement to use originating products from other members.

Environmental, Social and Governance (ESG)

ESG stands for Environmental, Social and Governance, which are considered the three main pillars of ESG frameworks. These pillars cover key areas that companies must address and report on. The … purpose of ESG is to identify and consider non-financial risks and opportunities associated with a company's day-to-day operations.

Environmental, Social and Governance (ESG)

ESG stands for Environmental, Social and Governance, which are considered the three main pillars of ESG frameworks. These pillars cover key areas that companies must address and report on. The purpose of ESG is to identify and consider non-financial risks and opportunities associated with a company's day-to-day operations.