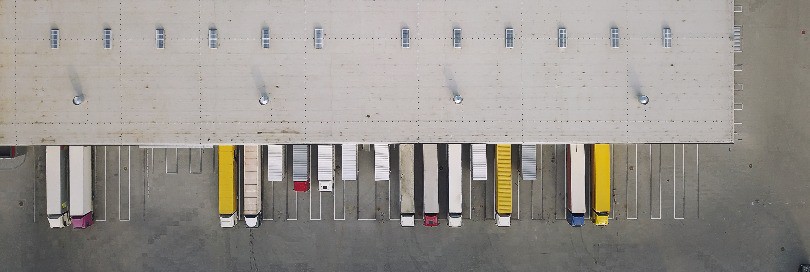

- Topic: customs control

Goods brought into the customs territory of the Union shall, from the time of their entry, be subject to customs supervision and may be subject to customs controls. They shall remain under such supervision for as long as is necessary to determine their customs status and shall not be removed therefrom without the permission of the customs authorities.

* Mandatory fields

By signing up you agree to the Terms of Use and Privacy Policy

Password reset

Check your e-mail, we sent you a link to reset your password.

Login with Google Login with LinkedIn

or Sign up

Already have an account? Login here

Already have an account? Login here

or Sign up

Contact us

Thank you for report

Maximum file size 6mb

File is too large

Comments ()

To post a comment you need to